25+ Nj Transfer Tax Calculator

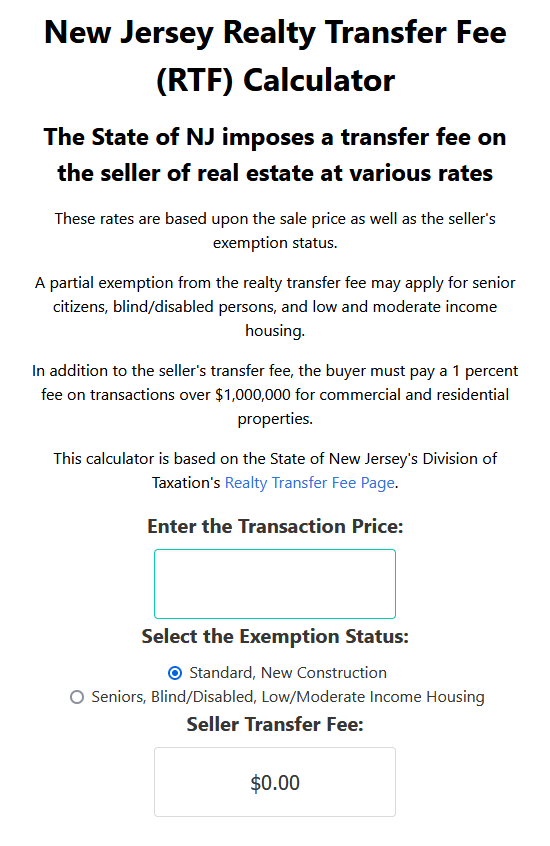

Web realty transfer fee. Web New Jersey Transfer Tax Calculator.

Uslaw Magazine Fall 2022 By Uslaw Network Issuu

Web NJ Realty Transfer Tax Calculator.

. 335500 of consideration in excess of 150000 but not in. The Rate Comparison Calculator provides an estimate of the Realty Transfer Fee that you will need to pay when you sell real estate property in. Web Debra Smith Esq.

Web Realty Transfer Fees. Web Real Estate Transfer Tax Calculator New Jersey. This Realty Transfer Fee RTF Calculator will calculate the RTF up to and over a million dollar consideration.

If you make 70000 a year living in California you will be taxed 11221. But please bear in mind that they are estimates only. New Jerseys Realty Transfer Fee RTF is calculated based on the amount of consideration recited in the deed or the assessed valuation of the property.

Your average tax rate. You should simply go to the calculator above choose the state of New Jersey and fill out the required. The Realty Transfer Fee is imposed upon the recording of deeds evidencing transfers of title to real.

Web Our calculator can be used to calculate transfer tax in New Jersey. Rates effective 332010. For example if a property sells for 500000 the real estate transfer fee would be calculated as follows.

The RTF is calculated based on the amount of consideration recited in. Web Realty Transfer Fee Calculator. Web California Income Tax Calculator 2022-2023.

Web NJ Transfer Tax. Web Our free NJ Transfer Tax calculator provides an estimate of the Realty Transfer Fee RTF that will be owed when selling real property in New Jersey. Senior citizen disabled persons lowmoderate income.

Web Realty Transfer Fee Calculator. Web For total consideration not in excess of 350000. 200500 of consideration not in excess of 150000.

Use these calculators to get an idea of the costs involved in your real estate transaction. Web The State imposes a Realty Transfer Fee RTF on the seller of real property for recording a deed for the sale. Consideration Amount.

54A8-8 through 8-10 require that nonresident sellers transferors and grantors pay estimated gross income tax in the amount of 2 of the consideration. Calculate Additional Transfer Fee. An Affidavit of Consideration RTF-1 must be filed with any deed in which a full or partial exemption is claimed from the Realty Transfer.

Web The amount of the fee is based on the sale price of the property. Web New Jersey Transfer Tax Rate Calculator Transfer Fee. The grantee is required to remit additional transfer fee of 1 of the consideration.

New England Market Based Sourcing Ppt

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

4 Guy St Dover Nj 07801 Trulia

Rajkot City And Survey Locations And Observed Land Value Download Scientific Diagram

Uslaw Magazine Summer 2023 By Uslaw Network Issuu

How To Calculate New Jersey Income Tax Withholdings

25 Cherokee Dr Galloway Nj 08205 Homes Com

New Jersey Transfer Tax Calculator Two Rivers Title Company Llc

Realty Transfer Fee Calculator Nj Realtors

1659 White Horse Pike Egg Harbor City Nj 08215 Compass

Hierarchical Levels In Energy Analysis From N J Peet 18 If Only Download Scientific Diagram

Pdf The Application Of Non Taxable Sales Value Of Tax Object In The Calculation Of Land And Building Tax

27 S Jackson Ave Atlantic City Nj 08401 Homes Com

New Jersey Online Realty Transfer Fee Rtf Calculator

Federal Register Takes Of Marine Mammals Incidental To Specified Activities Taking Marine Mammals Incidental To The Ocean Wind 1 Project Offshore Of New Jersey

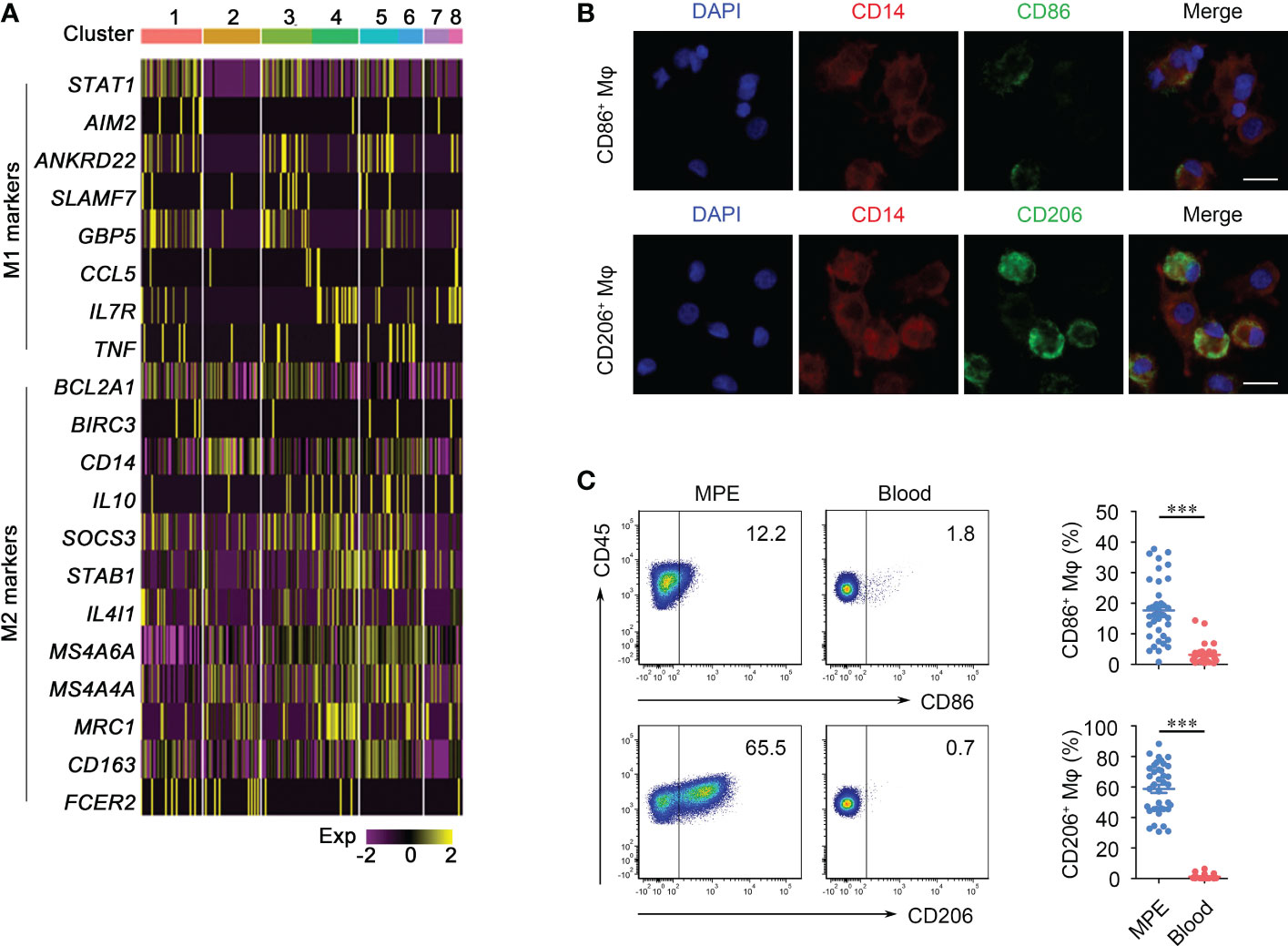

Frontiers Macrophage Derived Exosome Promotes Regulatory T Cell Differentiation In Malignant Pleural Effusion

Transfer Tax Calculator